Post #3, Have Farmland Values Appreciated in 2025? California and the Pacific Northwest

CALIFORNIA

The NCREIF California Row Crop Farmland portfolio has had a difficult time over the last two years, with losses in value in each consecutive quarter since Q2 2023. This is likely due to portfolio revaluations and exchanges in light of current and unknown future SIGMA impacts and other water issues within the state.

That said, annualized value losses may have bottomed out in Q3 of 2024 at (-5.64)% and the year over year Q3 2025 return has “improved” to only (-2.42)%. So far in 2025 the quarter over quarter returns are (-0.46%, (-0.04)%, and (-0.43)% for a year-to-date total of (-0.93)%. A Q4 2025 quarter over quarter gain of +0.927 would be needed just to get this region back to zero change in value vs last year. This seems unlikely but at least things are now moving in the right direction.

Pacific Northwest

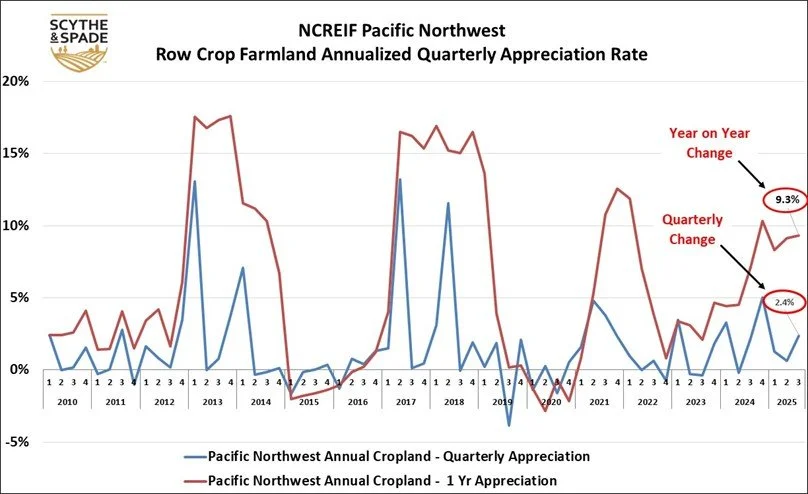

The NCREIF Pacific Northwest annual cropland portfolio includes properties in Oregon and Washington State. It is often an outlier in returns among the regions in the US and has the lowest correlation of returns with all other regions. True to form, it has continued to appreciate at accelerated rates while the others are retreating.

As of Q3 2025 it had appreciated 9.3% over Q3 2024 after a recent peak of 10.3% in Q4 2024. Q4 quarter of quarter returns for this region have been larger than Q3 in all but two of the last 21 years. This is likely in part because Q4 numbers usually include updated appraisal figures by the NCREIF members.

Looking forward to end of 2025 Q4 appreciation, we will almost certainly see a value gain over 2024, probably not lower than 6% for the year and quite possibly higher.