case study >>

working ourselves

out of a job

Our relationships with influencers in the industry mean that we are frequently called upon to offer insight or referrals. In this instance we were called upon by an attorney with whom we had a relationship to offer advice to one of his bank clients.

Challenge

Border Bank had $20 million in exposure to a client who operated several feedlots across two states. The bank relationship consisted of several related companies and included real estate mortgages and lines of credit secured by feed inventory, cattle, and receivables. The client had not met certain covenants and benchmarks, and was being asked to enter into a forbearance agreement.

We contracted with the bank’s attorney and began offering input during the drafting of the forbearance agreement. With our recommendations, the bank and client set up weekly monitoring requirements and budgets for repayment of the debts.

Solution

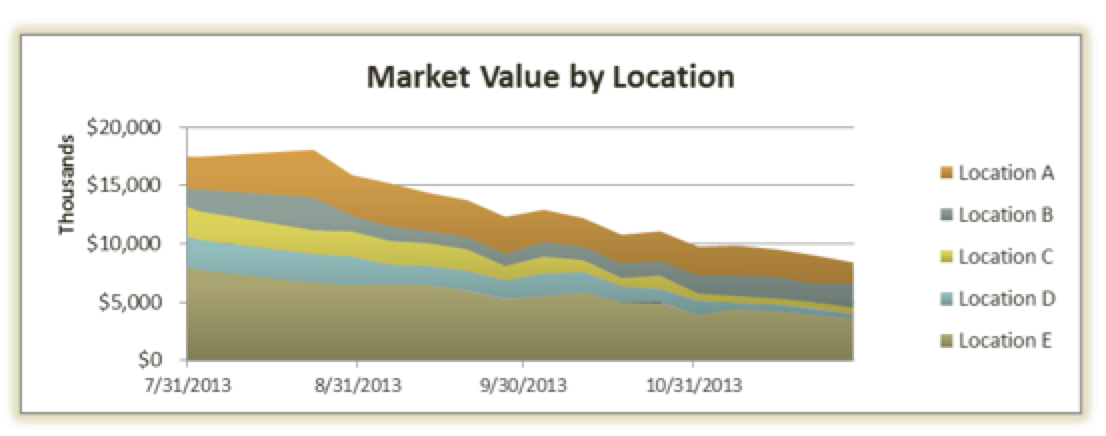

Border Bank had been using an inspector to conduct monthly counts of cattle inventory and less frequent counts of feed inventory. Upon review of bank and examiner documents, we noticed that the cattle valuations were determined by head count and NOT based on weight of the animals. Scythe & Spade developed a systemic approach to monitoring cattle levels using location, sex, head count, and weight size by pen with real time market values.

- Bank and legal counsel engaged our consulting services early in the process. We were able to offer insight into monitoring requirements.

- We reviewed monthly inventory and financial reports from the borrower and completed regular site visits and inventory audits to evaluated planned progress.

- We prepared monthly reports for legal counsel and the bank to measure performance against the forbearance agreement.

Despite early setbacks, the borrower was able to meet projected milestones. The positive trends rendered the need for additional consulting services unnecessary.