Mid-Year Agricultural Economic Outlook #2: Input Prices

Rising Input Prices Push Farm Margins Tighter:

The USDA tracks prices received and paid by farmers in the Agricultural Prices Report, an index utilizing 2011 as a baseline. Since January 2025 we have seen a steady increase in prices paid for input costs, with the June All Items index 10 points or 7.1% higher than the previous year.

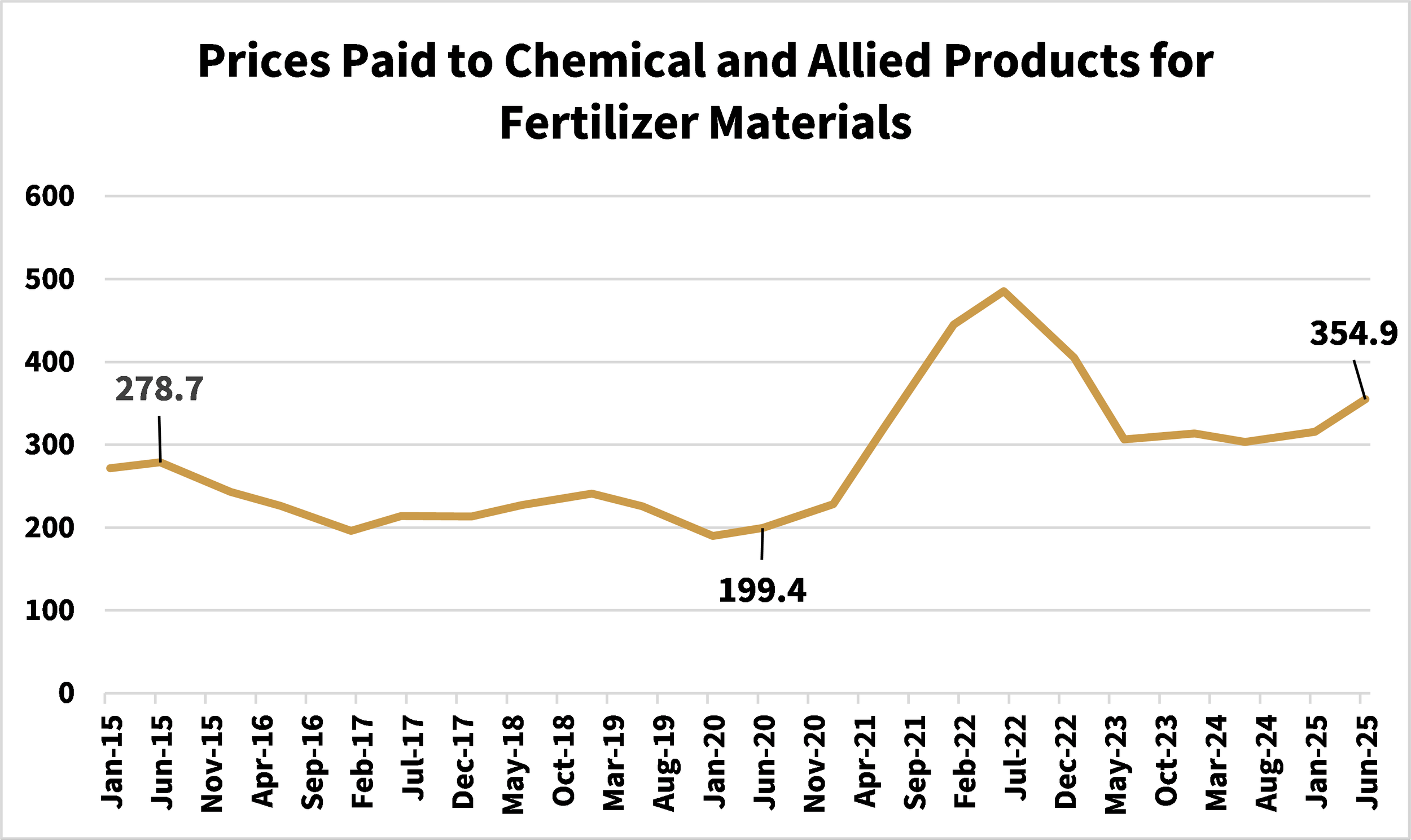

Fertilizer costs represent a large portion of these input cost increases, and a significant factor in the farm profit equation. Data from the Bureau of Labor Statistics shows that prices paid to chemical and allied products companies for fertilizer, seen below, have increased by 155.49 points in the past 5 years, or 21.47%. The global environment remains a significant contributor to these rising fertilizer prices. Conflict in Russia and Iran as well as reciprocal tariff threats in India, all top urea producing regions in the world, continue to add uncertainty to fertilizer costs moving forward.

The farm profitability equation is highly sensitive to changes in fertilizer, and fertilizer costs often serve as a leading indicator for total farm production costs. Production cost data from across the U.S. indicates that fertilizer accounts for as much as 27.78% of the total production cost across the U.S. With this share reaching as high as 50% for wheat production in the Delta.

Factor on top of higher input prices, a USDA forecast record corn yield and crop and the 2025/26 crop year is shaping up to be a difficult one for row crop farmers across the US. Implications and questions include what effect will be to farm loan delinquencies, foreclosures, lease rates and underlying farm ground values.